Nexus Community Report: Welcoming USDX

Over the past weeks, Nexus has continued to expand across infrastructure partnerships, global industry engagement, educational initiatives, and community-led creativity.

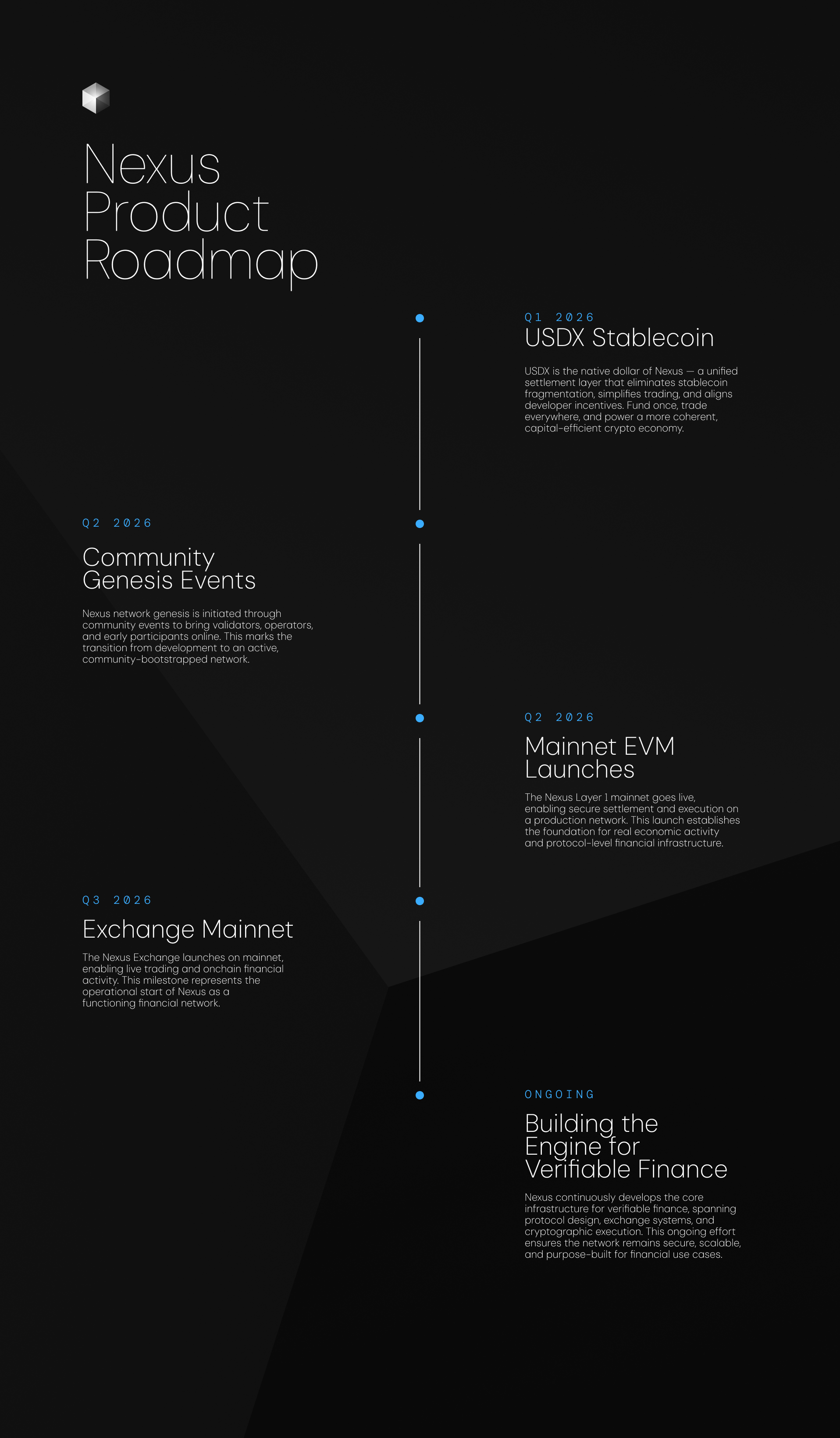

This post was updated on January 29, 2026 to reflect the latest updates to the Nexus roadmap.

When Nexus launched in 2024, it was introduced as a universal verifiable machine — a cryptographic system for proving anything, anywhere. That vision hasn’t changed. But its shape has evolved.

What began as a foundational system for verifiable computation is now becoming something more focused, more ambitious, and more urgently needed: a global financial layer built on proof.

This next phase is about building the infrastructure for verifiable finance — a system where transactions, strategies, and market behavior are provably correct. A system where every piece of logic that moves money can be traced, verified, and trusted by default.

Over the next several months, Nexus will transition from an experimental testnet ecosystem into a fully operational financial network.

Here’s what that path looks like:

The groundwork has already been laid at unprecedented scale. Over the course of 2024 and 2025, Nexus launched a sequence of increasingly advanced testnets to stress-test the network in production-like environments.

As we near the end of Testnet III, the numbers speak for themselves. Over 3 million users interacted with the system. More than 5 million nodes came online across 1,000 cities. The network processed upwards of 80 million transactions and verified 1.8 million smart contracts — supported by more than 96 active ecosystem partnerships. In total, the compute network attracted over 100 quadrillion FLOPs of contributed power.

These metrics are the clearest signal yet that verifiable computation can operate at planetary scale. And under the hood, the system is powered by zkVM 3.0 — a breakthrough upgrade that delivers a 1000x increase in throughput and laid the foundation for what comes next.

Throughout 2026, Nexus will undergo a structural shift. Testnet III evolves into a true Layer 1 chain. This new infrastructure serves two key purposes: first, to onboard developers and infrastructure partners into a stable, persistent environment; and second, to prepare for validator onboarding and network finality ahead of full Mainnet activation.

This phase introduces performance-tuned EVM compatibility, along with a phased rollout of independent validators alongside the global prover network. It’s where experimentation ends and engineering precision begins — a system stress-tested by real users, now prepared for real-world deployment.

One of the defining features of Nexus is enshrinement — the idea that core financial infrastructure should be built directly into the protocol layer, not left to third-party smart contracts.

In Q1 2026, the first enshrined financial application will go live on testnet. This high-performance matching application embedded directly into the EVM will be governed by deterministic logic and integrated with the Nexus OS.

Developers will be able to plug into it through a dedicated API layer, and users will interact with the application natively, without needing to leave the protocol environment.

The enshrined application will turn verifiability into a first-class primitive — something predictable, composable, and provable from the start.

In Q2 2026, Nexus will enter production with the full launch of Mainnet. This is where the system becomes durable: bridges and onramps go live, developers deploy applications into a stable environment, and the network transitions into a fully operational financial layer.

Unlike most L1 launches, this won’t be a blank canvas. Validators, provers, and oracles will already be in place. The ecosystem will have a base layer designed to support programmable verifiable financial systems from day one.

While most networks stop at deployment, Nexus continues to evolve its proving infrastructure. The release of zkVM 4.0 in mid-2026 marks a leap forward in verifiability and performance.

This version introduces batching for parallel execution, instruction sorting to reduce proving time, and recursive composition to support more complex, layered logic.

For developers, this means access to a more powerful, more efficient zkVM — one capable of proving high-frequency strategies, multi-stage computations, and fully stateful applications. Precompile support further accelerates common cryptographic operations, unlocking even broader use cases.

In short: verifiable execution gets faster, cheaper, and more expressive, extending the reach of what’s provable across the entire financial stack.

Verifiable finance extends to every layer where economic behavior is defined — from vault construction to collateral frameworks to composable, risk-aware automation.

Over time, Nexus will expand support for new asset types, diversify collateral models, and onboard entirely new classes of financial applications.

The broader vision is not just to build infrastructure that proves things — but to shift the burden of trust itself. To create a system where the rules are visible, execution is guaranteed, and participation is open to anyone who can compute.

Most Layer 1 protocols are value-negative: they burn capital faster than they generate fees, and they rely on subsidies rather than usage.

Nexus is designed to break that pattern. By embedding high-value functionality directly into the base layer — and proving every operation with cryptographic integrity — the Layer 1 becomes self-sustaining and becomes an operating system for global markets.

Nexus is now focused on bringing the Nexus Exchange to life. Over the coming months, we will concentrate on exchange development, liquidity infrastructure, and operational readiness, with the explicit goal of launching mainnet as quickly and safely as possible.

This stage marks Nexus’s transition from testnet experimentation to a live, production network — unlocking real participation and setting the foundation for long-term growth of the ecosystem.