Exponential Episode 25: Invisible Infrastructure

In this episode of Exponential, Jin Kwon, co-founder of saga.xyz, explains how blockchain infrastructure will disappear into the background.

Modern financial systems depend on speed, determinism, and consistency. Exchanges must process tens of thousands of orders per second, payment networks maintain global state with millisecond precision, and market infrastructure is engineered to remain predictable under immense load.

Blockchains, however, were not originally built for these demands. General-purpose virtual machines like the EVM share limited resources across all applications and operate under latency and gas constraints that make real-time financial operations difficult or impossible to execute natively.

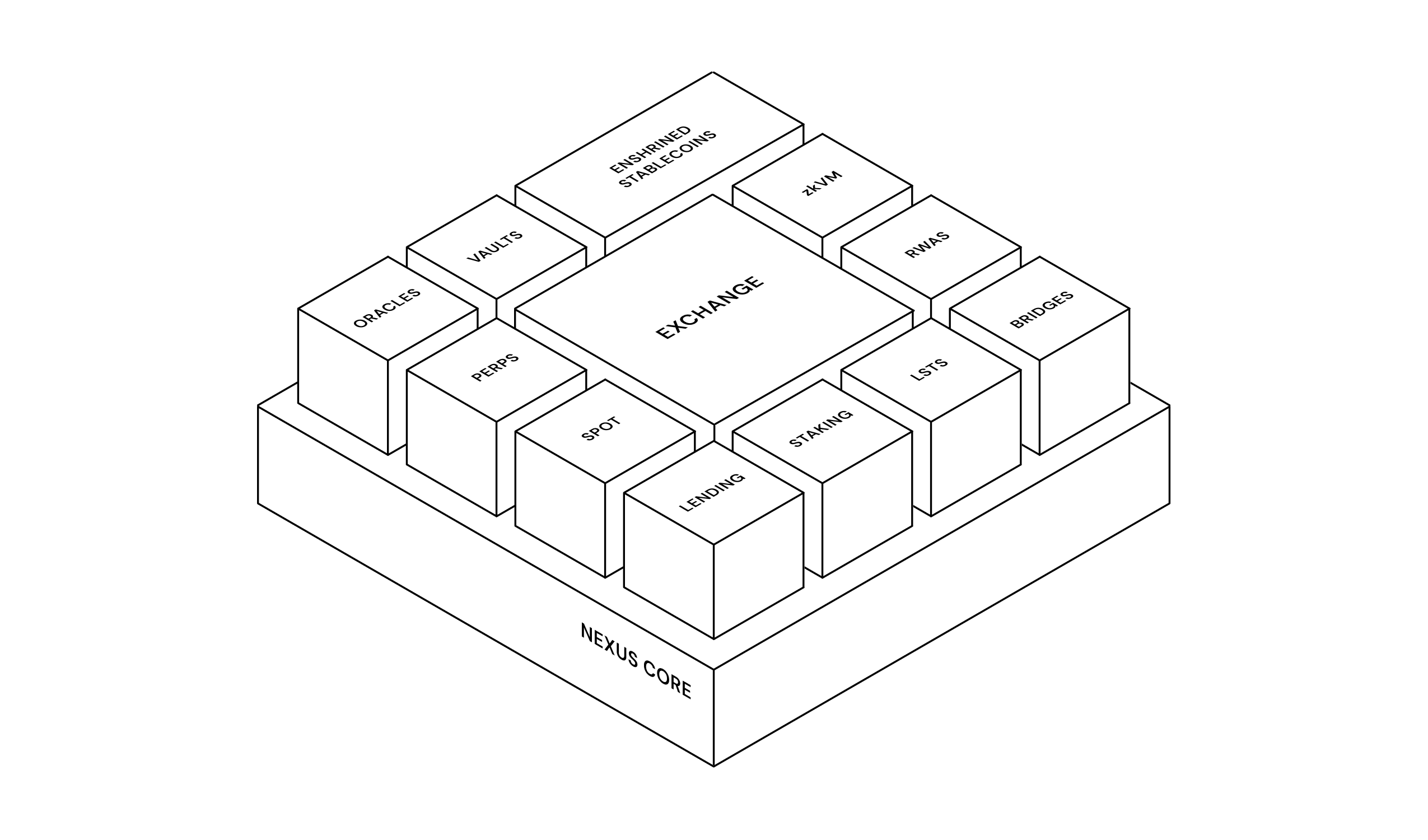

NexusCore is the component of the Nexus Layer 1 that addresses this mismatch. It is a specialized execution environment designed for financial primitives that require deterministic performance and sub-100-millisecond latency.

NexusCore introduces enshrined co-processors — native execution engines built directly into the protocol — that deliver centralized exchange-level throughput within a fully transparent, distributed system. These co-processors allow developers to build new types of high-frequency trading venues, lending systems, payment protocols, and market operations that were previously impractical onchain.

Traditional smart contract environments are intentionally flexible but inherently limited. Because every program runs through the same VM and competes for the same gas market, the platform cannot guarantee the performance that real-world financial systems demand. NexusCore extends the capability of a general-purpose EVM Layer 1 by introducing native engines optimized for specialized financial workloads.

Each co-processor functions as an independent state machine with its own logic, memory, and data models, and each delivers predictable, deterministic performance validated through the NexusBFT consensus protocol.

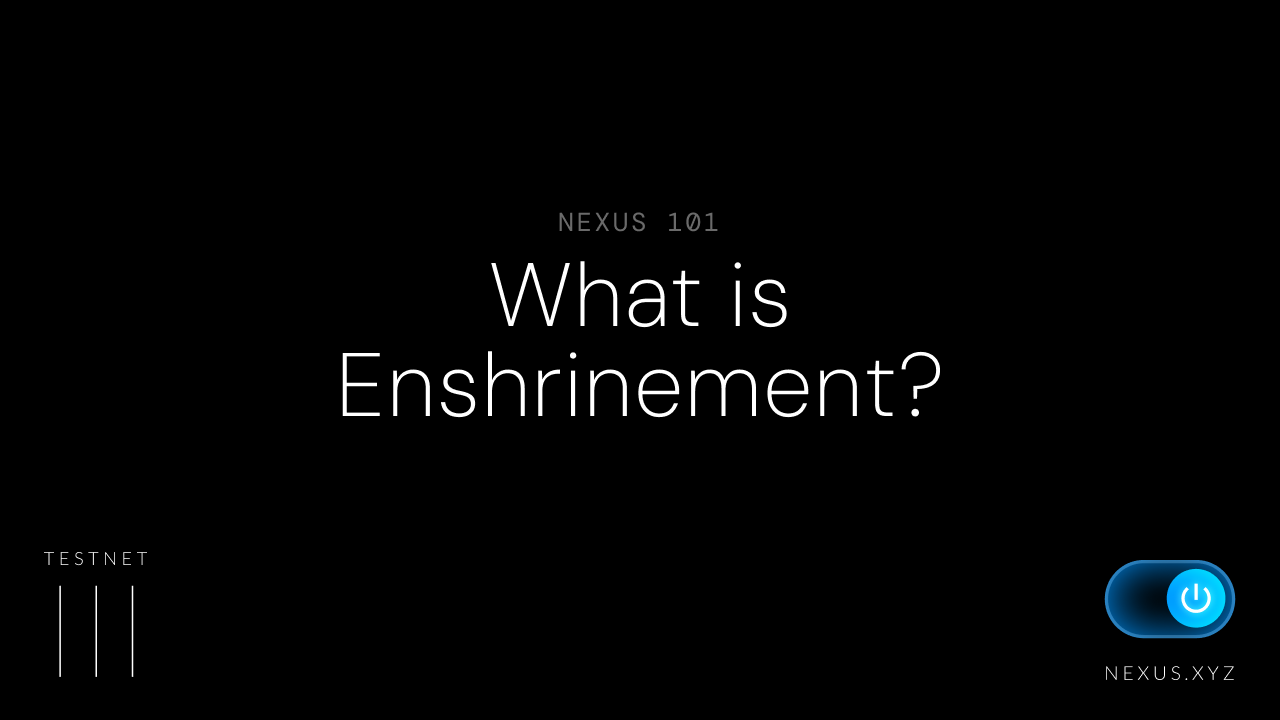

A co-processor in NexusCore is a native module integrated into the protocol to perform a specific category of financial computation. A co-processor executes pre-compiled logic with direct access to protocol resources. Its design is organized around three layers of state management.

This layered structure ensures that each co-processor is isolated, independently executable, and safe to optimize or parallelize. State machine independence allows multiple co-processors to operate simultaneously without contention. Because each module is isolated and validated under shared consensus, NexusCore supports parallel processing, safe upgrades, and the introduction of new financial engines over time. This modularity provides the network with a flexible path to expand capacity while maintaining deterministic execution across validators.

The dual interface architecture is one of NexusCore’s defining features. Developers and professional trading systems can interact with co-processors through low-latency native APIs such as REST or WebSocket endpoints, enabling direct integration with existing market infrastructure.

At the same time, smart contracts can invoke the same co-processor functions via EVM precompiles, allowing atomic, composable interactions within a single transaction. This unified interface model enables high-frequency trading strategies to operate alongside programmable DeFi logic within the same network, without either domain constraining the other.

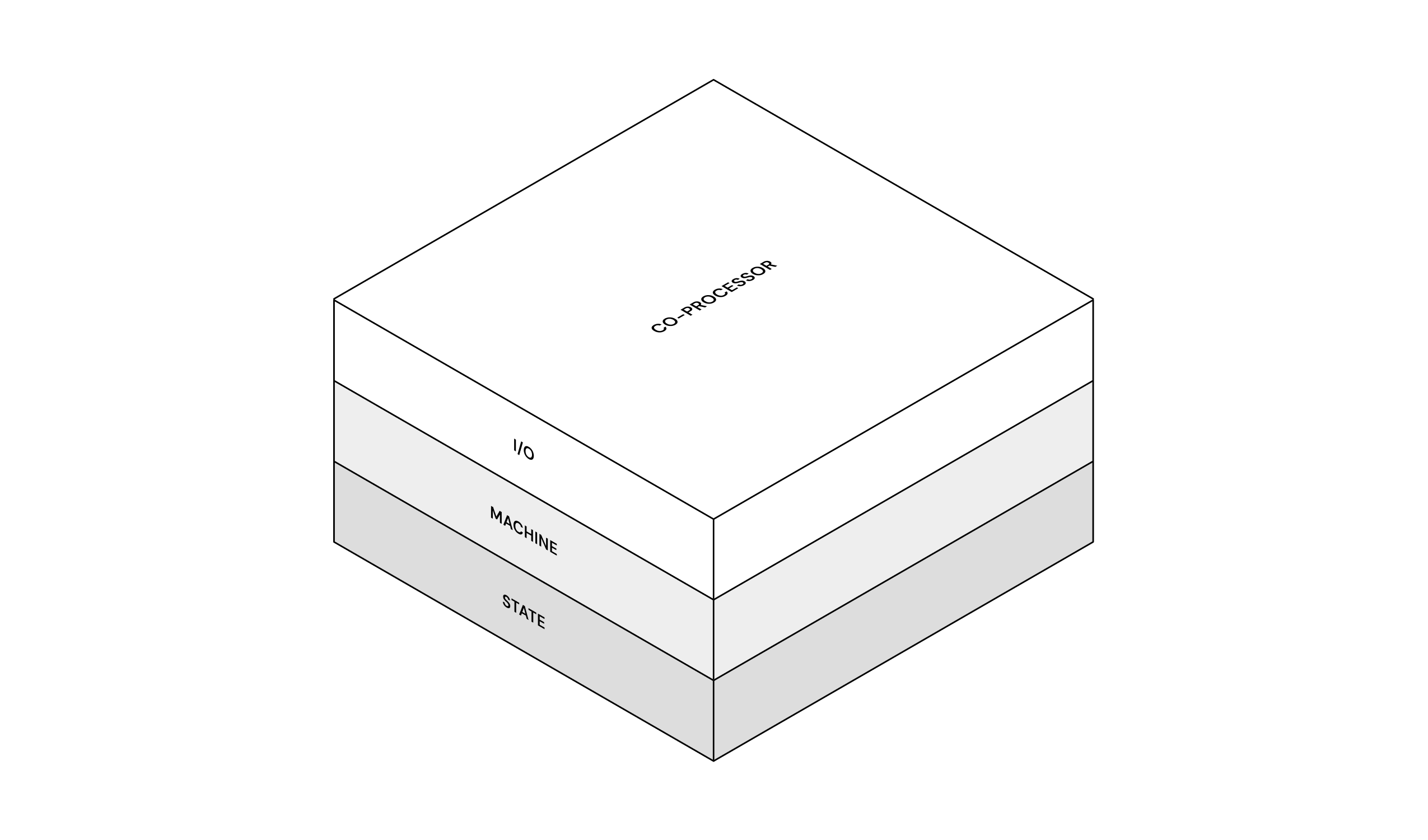

The first co-processor implemented in NexusCore is the perpetual futures exchange engine, introduced with the Nexus DEX Alpha. This co-processor demonstrates the architectural advantages of enshrined financial execution.

The exchange engine provides throughput exceeding 100,000 orders per second, real-time risk management and liquidation logic, and APIs that allow existing trading systems to migrate directly onto the network. It also exposes onchain EVM precompiles, enabling developers to build composable DeFi strategies and applications that integrate directly with a high-performance onchain exchange.

More broadly, NexusCore establishes a modular co-processor ecosystem that allows the Layer 1 to grow by adding new specialized execution engines.

Developers can deploy permissionless, revenue-generating DEXs and other high-frequency markets for any asset class, while leveraging shared engines for margin, risk, and order execution. This architecture transforms Nexus into a platform capable of supporting verifiable, high-speed financial applications that operate at global scale.

In essence, NexusCore turns the blockchain from a single general-purpose virtual machine into a collection of specialized financial state machines, each optimized for a specific purpose and all secured by a unified consensus layer.

By combining the performance of centralized exchanges, the composability of DeFi, and the transparency of verifiable execution, NexusCore makes it possible to build markets that are both fast enough for real-world finance and trustworthy enough for onchain verification.

As financial systems continue to evolve and become more automated, more global, and increasingly powered by AI, NexusCore can provide a foundation for creating verifiable markets for virtually anything.