Exponential Episode 26: DeFi Yield

In this episode of Exponential, Laszlo Szabo, co-founder and CEO of Kiln, joins to talk about one of the most

For years, most onchain trading relied on automated market makers (AMMs). They offered a breakthrough for decentralized finance because they were accessible, composable, and easy to integrate. But the reliance on automated market makers also came with tradeoffs. Precision, speed, and capital efficiency all take a backseat to simplicity.

That’s changing.

With the rise of onchain Central Limit Order Books (CLOBs), we’re seeing a structural evolution. CLOBs import the market mechanics of traditional finance, things like limit orders, order depth, price-time priority and incorporate them into fully decentralized systems. They give traders more control, tighter execution, and more transparent price discovery.

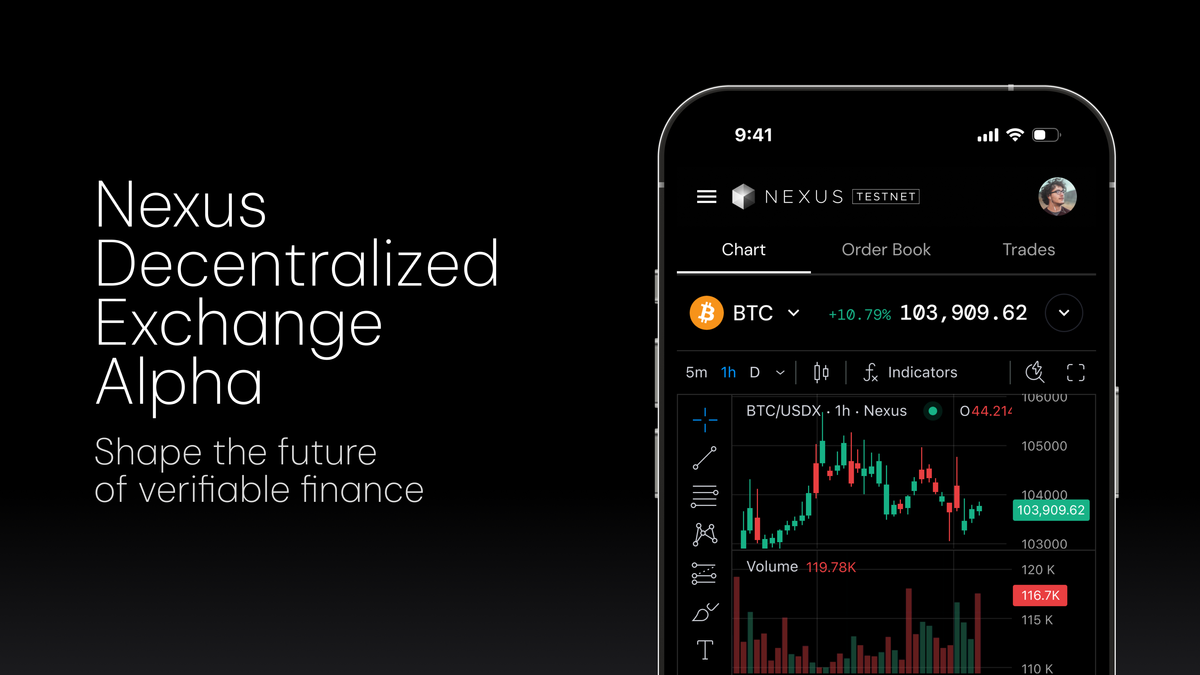

Last week, we launched the Nexus DEX Alpha: a high-performance, onchain CLOB optimized for speed, fairness, and deep liquidity. It’s built from the ground up to bring modern market structure to decentralized trading.

But new mechanics bring new vocabulary. If you’re coming from centralized trading platforms this glossary breaks down the core concepts that shape the Nexus DEX experience and the new era of decentralized finance.

These are the building blocks of how orders are placed, matched, and executed on Nexus.

A CLOB is the digital ledger where all buy and sell orders live, sorted by price and time. It matches buyers and sellers transparently, without intermediaries.

Why it matters: Unlike AMMs, where you trade against a pricing curve, CLOBs let traders interact directly. You control exactly what price you’re willing to buy or sell at and your order competes fairly with others on the same terms.

An order placed on the book that doesn’t execute immediately. It waits to be matched by another trader.

Why it matters: Maker orders add liquidity to the system. By placing one, you’re helping build a healthier market and you can often trade at better prices than by crossing the spread.

An order that executes immediately against the best available price on the book.

Example: A market order is always a taker and it accepts the current price to guarantee immediate execution.

Why it matters: Takers provide urgency, not patience. In fast-moving markets, taking liquidity may be worth the trade-off in execution price.

The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

Example: If the best bid is $10 and the best ask is $10.03, the spread is $0.03.

Why it matters: Tighter spreads mean more efficient markets. Narrow spreads reduce the cost of trading and signal high liquidity.

The difference between your expected execution price and the actual price you get.

On Nexus: Since you’re trading with limit orders, you can set exact price boundaries and avoid slippage entirely, which is different than on AMMs, where large trades can distort the curve.

These terms apply when trading perpetual futures, which are derivatives that allow long and short exposure with leverage.

Contracts that track an underlying asset’s price but never expire. Traders can go long or short indefinitely.

Why it matters: Perps give you directional exposure either up or down, without needing to own the underlying asset.

A regular payment between long and short positions, designed to anchor the perp’s price to spot.

Example: If the perp price is trading above spot, longs will pay shorts. If it’s below, shorts pay longs.

Why it matters: The funding rate creates a feedback loop that keeps prices aligned with the real market.

The ability to control a large position with relatively little capital.

Example: 5× leverage means a 1% move in price results in a 5% change in your position’s value.

Why it matters: Leverage amplifies both gains and losses. Used well, it increases capital efficiency. Used poorly, it increases risk of liquidation.

The automatic closing of a position when your margin no longer covers potential losses.

Why it matters: Managing position size and risk is essential. A good DEX provides real-time margin tracking and fair pricing to help reduce the risk of liquidation.

A calculated fair price used to determine margin and liquidation thresholds, which are designed to avoid manipulation.

On Nexus: The mark price is derived from a time-weighted average of real market data, smoothing out short-term volatility spikes.

The underlying architecture is what makes the Nexus DEX different.

All trades, collateral movements, and position updates settle directly onchain.

Why it matters: There’s no hidden database, no offchain clearing. Every trade is verifiable, transparent, and secured onchain.

The autonomous code that powers the exchange. It handles everything from order matching to margin checks to fund custody.

Why it matters: Smart contracts enforce the rules with no middlemen. They can’t be bribed and they execute exactly as written.

Transaction fees or the cost of executing operations onchain. Gas fees can also be viewed as user fees because they are paid to the network validators.

Why it matters: The goal is to optimize contract design to minimize gas usage without compromising security. Efficient contracts result in lower trading costs.

The rise of onchain CLOB DEXs opens the door to high-performance, verifiable trading infrastructure that doesn’t compromise on decentralization.

With Nexus DEX Alpha, we’re making that future usable today. This glossary is your guide to understanding the mechanics behind the experience.