Exponential Episode 25: Invisible Infrastructure

In this episode of Exponential, Jin Kwon, co-founder of saga.xyz, explains how blockchain infrastructure will disappear into the background.

Crypto exchanges weren’t built for traders — they were built for volume. For too long, users have had to choose between speed and security, usability and decentralization, flexibility and control.

That ends now.

Today, we’re launching the Alpha version of Nexus DEX, a high-performance decentralized exchange for perpetual futures. It’s built on verifiable infrastructure, and designed with a single principle in mind: the trader comes first.

The Alpha, which is part of the ongoing Testnet III, is intentionally light. It’s a focused, streamlined experience that includes only the essentials. But beneath its simplicity is a powerful architecture that reimagines how exchanges should work — transparent, high-performance, and shaped by the people who use them.

At Nexus, our foundational belief is that systems should be verifiable. Everything we build is grounded in the idea that infrastructure should be provable in how it operates, accountable in how it evolves, and free from hidden behavior or intervention.

That principle now extends to trading.

Nexus DEX Alpha is a non-custodial CLOB DEX powered by a native orderbook engine. It’s engineered to deliver institutional-grade performance while becoming decentralized over time. This includes low-latency execution, deep liquidity, and fast trade matching — all without requiring users to hand over custody of their assets or trust opaque backend logic.

Just as important, the platform is being developed in the open. Rather than dictating what the exchange should be, we’re launching the Alpha to co-create it with our community. Every aspect of the product — from interface design to risk management — will evolve based on real user feedback.

The Alpha release is not a full-featured launch, but it is a solid foundation. We’re prioritizing core functionality and a clean, accessible interface to give traders a feel for the Nexus DEX experience — and then actively incorporating feedback to shape what comes next.

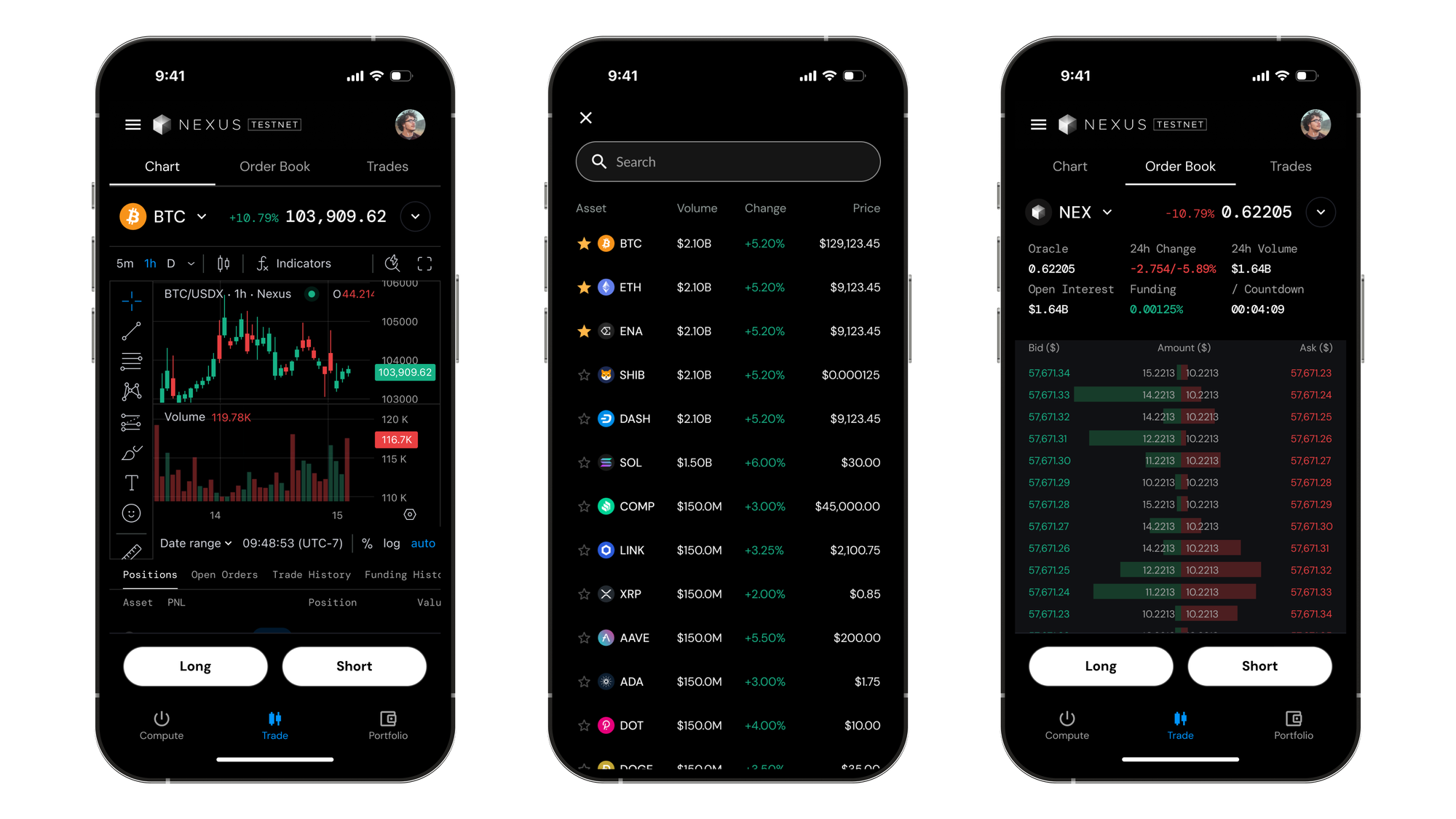

From the first interaction, users will notice thoughtful design choices. A simplified interface reduces the cognitive load of trading and includes intuitive long and short buttons instead of the more ambiguous buy and sell. The product is optimized for both desktop and mobile, with a consistent experience across platforms. Onboarding is frictionless, and users who don’t already have a wallet can create a Nexus wallet directly in the signup flow.

You can’t use real money during the Alpha phase. Instead, you’ll be able to claim test “money” to try the decentralized exchange experience. Our goal is to remove as much friction as possible so traders can explore the platform, understand how it works, and help us improve it before the full rollout.

While the Alpha is intentionally simple, the underlying architecture is built for scale. Nexus DEX runs on a high-performance native orderbook designed for minimal slippage, fast execution, and the ability to handle high-throughput workloads. The platform will eventually support up to 50x leverage and stablecoin margin trading, with native APIs that cater to institutional, algorithmic, and agentic-driven strategies.

We’re aiming to match, and ultimately exceed, the performance of centralized exchanges — while staying true to the principles of decentralization and transparency. That balance between speed and sovereignty is at the heart of everything we’re building.

The Nexus DEX Alpha is part of a broader, verifiable product ecosystem that makes system behavior provable rather than opaque.

Our underlying enshrinement architect will allow us to progressively introduce cryptographic proofs across the stack, starting with a small percentage of chain activity and increasing over time. For users, this means the ability to verify key exchange behaviors — such as order matching or settlement logic — without relying on external assurances or closed-source code.

Volatility is part of the market. But surprises shouldn’t be. Nexus DEX is being designed to minimize confusion and protect users during high-risk scenarios, particularly around liquidations.

Future iterations will introduce real-time transparency tools that help traders understand risk exposure as conditions change. The platform will prioritize portfolio visibility and composability, giving users a clearer view of how their positions behave. Most importantly, our approach to risk management is aligned with the values of verifiability and decentralization — meaning we design systems that don’t require intervention or special privileges to protect users.

We’re not here to control user behavior or trader decisions. Instead, we are setting out to make sure the system doesn’t fail them when it matters most.

What launches today is only the beginning. Over the coming months, we’ll roll out features that build on the Alpha: customizable UI components, user profiles tied to Nexus accounts, unified balance management across products, and integrated educational tools to support both novice and professional traders.

But what we prioritize will be based on what we learn. Every decision will be grounded in real usage, not assumptions. And that’s where you come in.

If you’re a trader looking for better tools, a developer exploring verifiable finance, or simply curious about what comes next, we invite you to be part of it.

Help shape the future of trading.