USDX, Powered by M0: The Native Dollar of the Verifiable Economy

In today’s fragmented stablecoin landscape, many systems are either chasing liquidity or retrofitting incentives. Traders face operational complexity, developers

In traditional finance, speed and trust are often at odds. Centralized exchanges offer low-latency trading and deep liquidity—but at the cost of opacity, custody risk, and system fragility. Blockchains promise transparency and composability, yet they struggle to meet the real-time demands of modern markets.

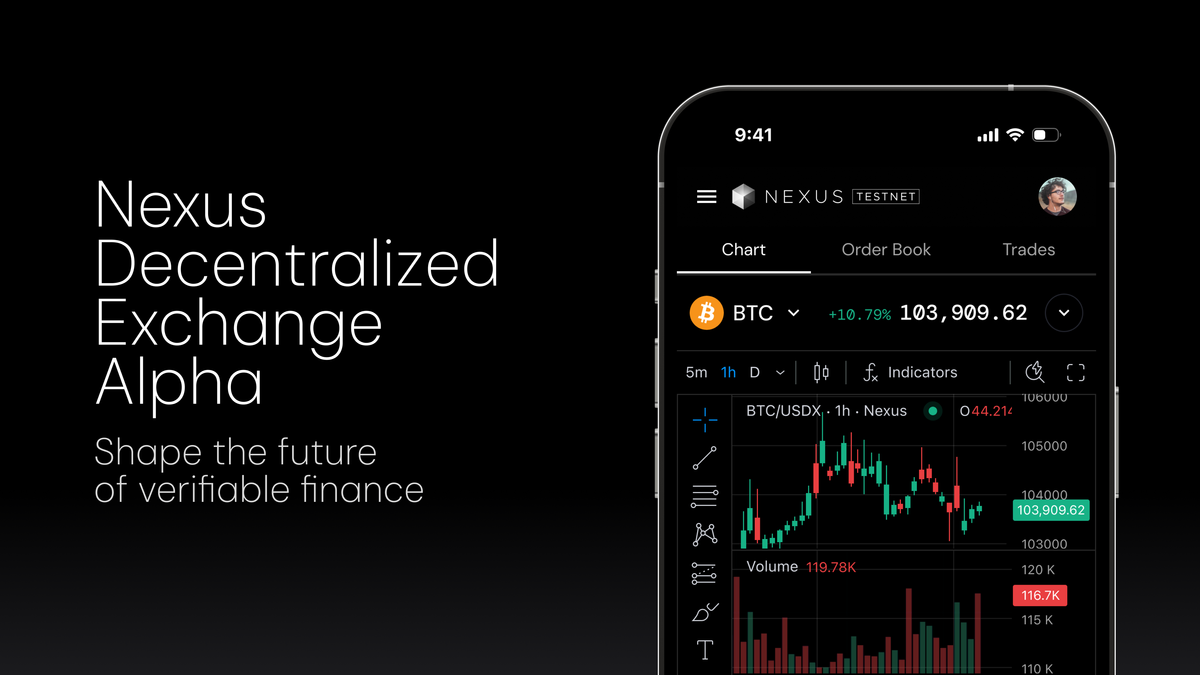

Nexus was built to resolve this tension. With the launch of the Nexus DEX Alpha, we’re introducing a new kind of decentralized exchange—one designed from first principles to combine institutional-grade performance with cryptographic verifiability and developer-friendly composability for specialized financial applications.

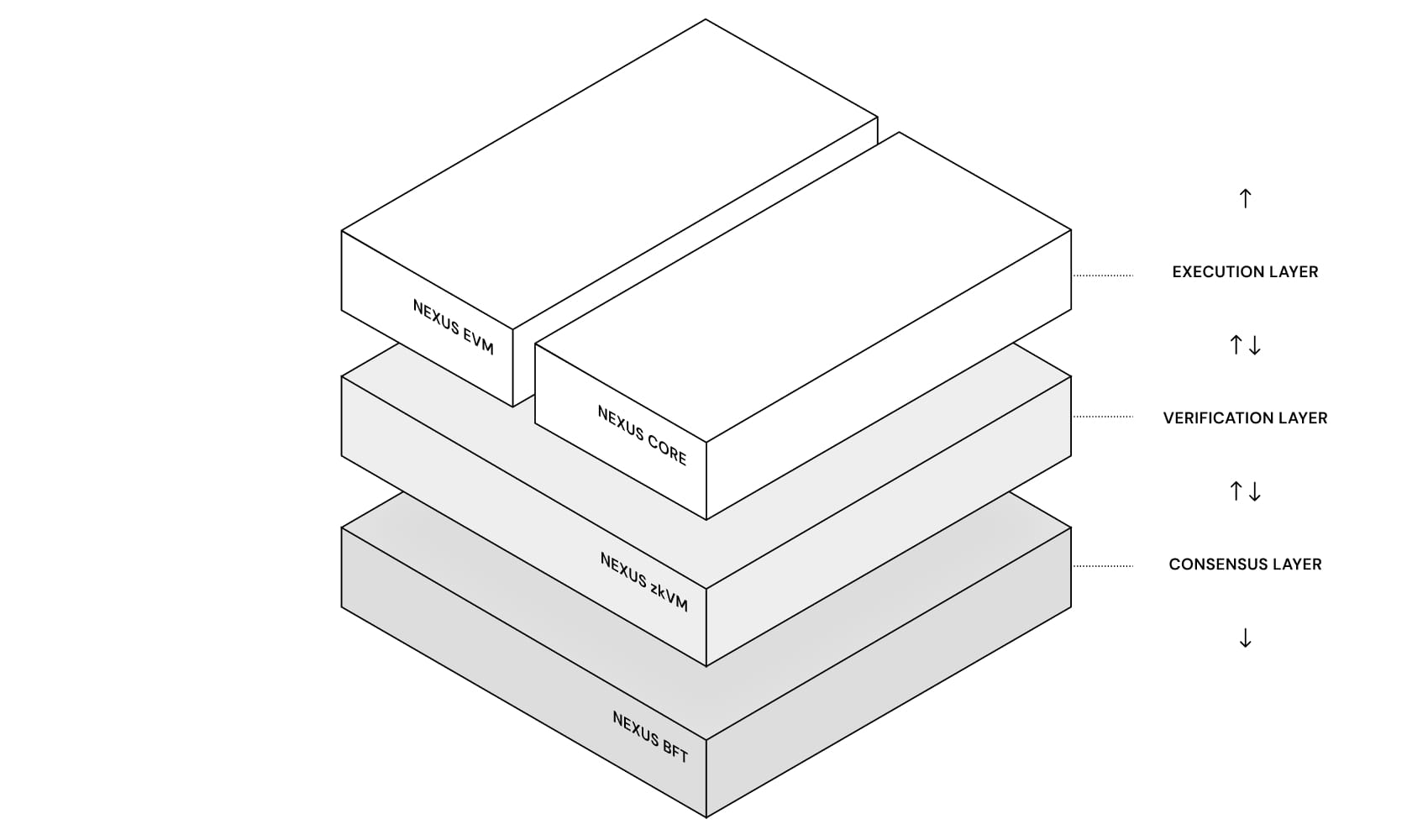

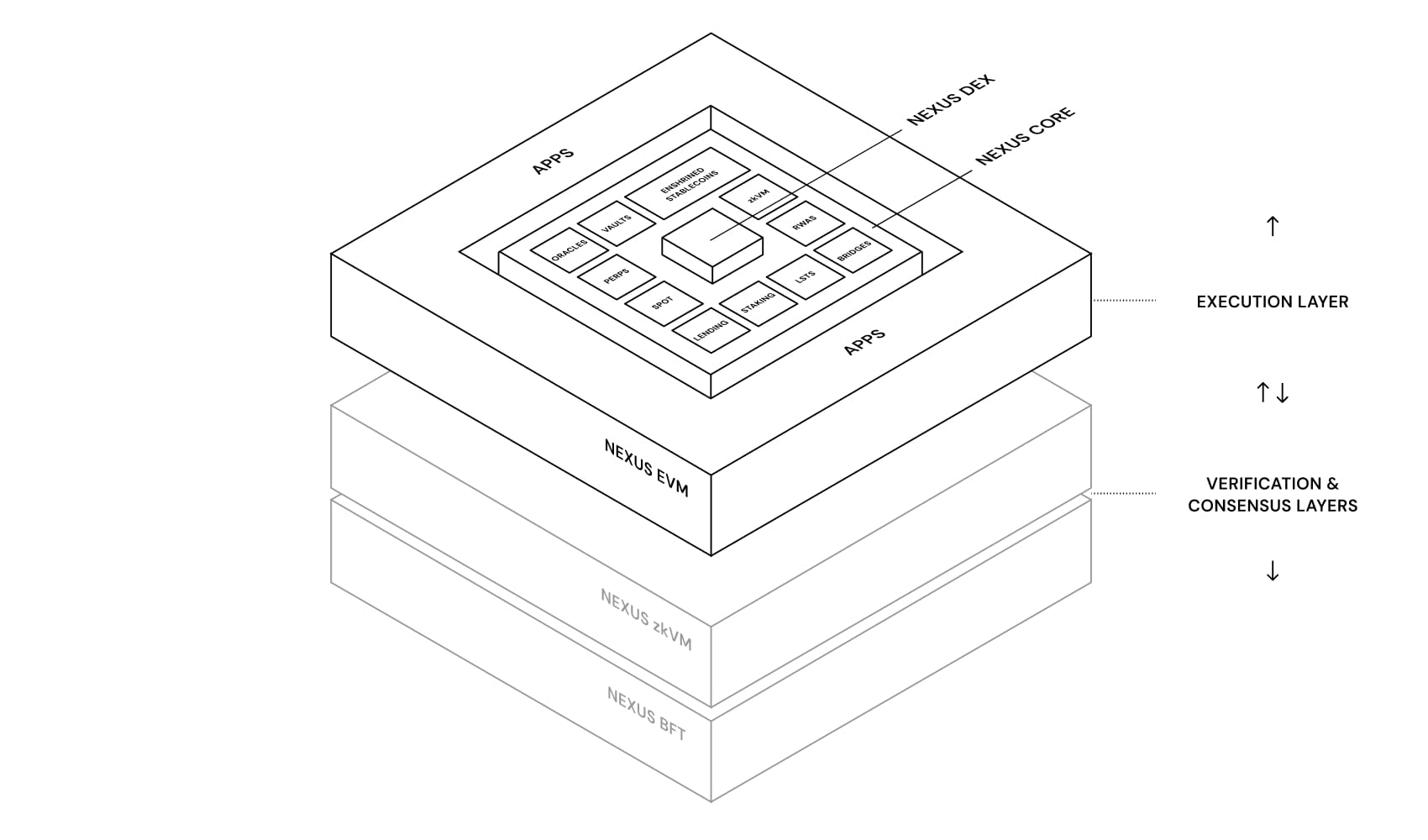

At the foundation of Nexus is a three-layer blockchain architecture that separates execution, verification, and consensus into independently optimized systems. These layers work together to deliver high-throughput performance while preserving cryptographic correctness and decentralization.

At the Execution Layer, Nexus runs a dual-client architecture: NexusEVM and NexusCore. NexusEVM is general purpose and offers full compatibility with Ethereum, including support for Solidity, standard tooling, and composable applications. In parallel, NexusCore provides a high-performance execution environment purpose-built for financial computation. It hosts enshrined co-processors that handle matching, liquidation, pricing, and settlement.

At the base of the stack is the Consensus Layer. NexusBFT, the chain’s custom Byzantine Fault Tolerant protocol, finalizes dual-execution blocks with sub-second latency. It manages validator coordination and maintains the on-chain registry of co-processors that underpin the network’s modular execution.

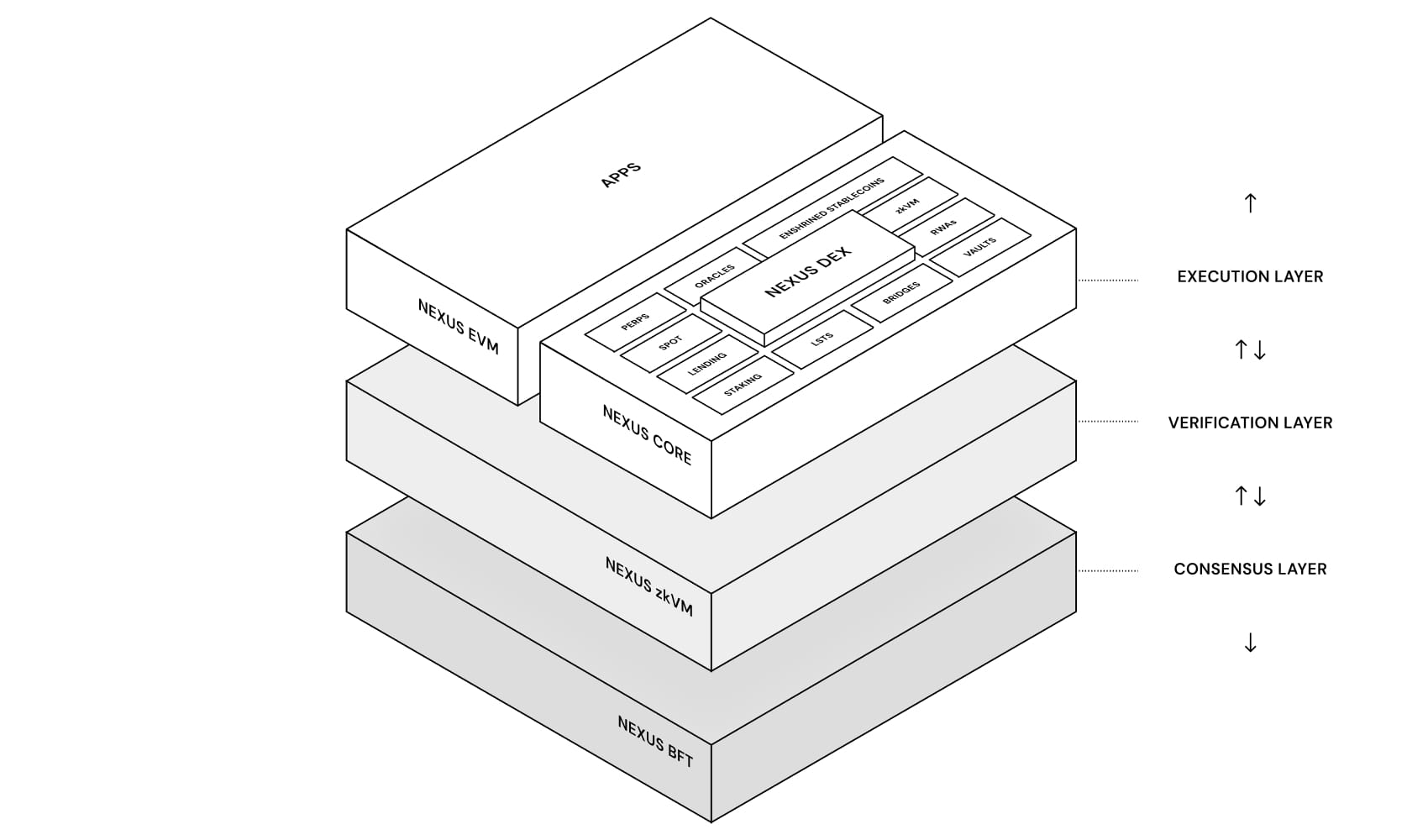

Where most general-purpose chains compromise between flexibility and performance, Nexus takes a different approach. The architecture introduces protocol-level co-processors—enshrined, specialized engines built directly into the base layer—that provide critical financial infrastructure out of the box.

Developers building on NexusCore gain access to high-throughput matching engines, real-time oracle feeds, native liquidation systems, and other exchange-optimized primitives. These engines are not only performant but also fully composable with the rest of the ecosystem. Apps deployed on NexusEVM can tap directly into these co-processors to power complex market mechanics—without needing to bootstrap external infrastructure or rely on custom rollups.

Trading APIs exposed at the node level allow low-latency strategies to run natively on Nexus, while the parallelized execution model eliminates head-of-line blocking across independent orderbooks.

Meanwhile, the Nexus zkVM plays a key role in scaling the network’s integrity guarantees. Already deployed across millions of devices, the zkVM enables distributed proof generation across a decentralized network of provers. While still in its early stages, this system is designed for horizontal scalability, allowing Nexus to handle increasingly complex workloads without sacrificing cryptographic guarantees.

At the center of the architecture is the DEX, a native component of NexusCore that provides the core liquidity and trade settlement infrastructure for the network. This engine is not an application layer protocol but an enshrined, system-level module that supports shared liquidity across the entire chain.

The architecture positions NexusCore and the Exchange Engine at the literal and functional center of Layer 1. All trade execution, order management, and liquidation logic runs through this engine, offering a single source of truth for onchain financial computation. Liquidity is treated as a native resource—shared, permissionless, and composable across all applications built on Nexus.

The Nexus DEX Alpha, now live on testnet at app.nexus.xyz/trade, demonstrates this system in action. It offers users a test environment to explore BTC-USD perpetual futures trading with up to 50x leverage. This Alpha release is designed to showcase the network’s core performance and architecture, while inviting community feedback to shape its evolution.

As with any early-stage protocol, the current environment is experimental and subject to change. Not all planned features are available yet, and system parameters may be adjusted rapidly as we iterate and scale. Nonetheless, the alpha represents a clear preview of what’s to come: a high-performance, verifiable trading platform built natively into the blockchain itself.

Looking ahead, Nexus will continue rolling out additional components of its architecture, expanding the co-processor suite, and deepening integrations across the execution and verification stack. The goal is to create a financial infrastructure layer that can support the full spectrum of global market activity: verifiable, composable, and optimized for performance from the protocol up.