USDX, Powered by M0: The Native Dollar of the Verifiable Economy

In today’s fragmented stablecoin landscape, many systems are either chasing liquidity or retrofitting incentives. Traders face operational complexity, developers

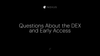

The Nexus DEX is a protocol-native trading engine. What makes it different is that it is the first in a series of deeply integrated co-processors that will power the Nexus financial layer — and it’s already live, in alpha, for early contributors to the ecosystem.

Here’s what you need to know about how the DEX works, how it’s different, and how to get involved.

At Nexus, we believe that exchange is the foundation of any financial system — and that programmable finance begins with a performant, credible, and verifiable market structure.

The goal of the Nexus Layer 1 is to create the infrastructure for a new programmable form of finance, verifiable finance, where verifiable computation matters most.

Rather than grafting a DEX onto the protocol, we’re building a DEX that operates at the root protocol level. This alpha release is our first demonstration of what that unlocks.

Most decentralized exchanges today fall into one of two categories. There are AMMs that run as smart contracts on general-purpose chains. These work well for long-tail assets, but sacrifice precision and speed. Then there are high-performance exchanges, which operate with off-chain sequencers and a blockchain attached — a model that prioritizes speed but gives up transparency and verifiability.

Nexus takes a fundamentally different approach. We’ve built a central-limit orderbook (CLOB) exchange directly into the protocol.

Developers and traders will be able to interact with the exchange through APIs that match those used by high-frequency trading systems in traditional markets. That means colocation strategies and trading bots can now run directly onchain, with predictable performance and sub-second finality.

Eventually, more trade and transaction information will be verifiable via the Nexus zkVM, forming part of the Universal Proof system.

The DEX is live but in the alpha stage of product development. We’re currently gathering a group of interested users who will help us battle-test the system, refine the interface, and shape the product through feedback.

We will begin sharing early access codes with people who have signed up soon and we will continue sharing codes in waves as space opens up over the next several weeks. If you’ve already signed up but haven’t received an access code yet, don’t worry – this is a normal part of the process. We greatly appreciate your interest and help in building this product.

The Nexus DEX is a central-limit orderbook exchange. The Alpha currently supports perpetual futures markets. Over time, the plan is to extend the infrastructure to support a broader range of financial products, including spot markets, options, real-world assets, FX, prediction markets, and treasuries — all programmatically composed at the protocol level.

The DEX and the zkVM are part of a shared roadmap. While the current Alpha does not rely on zkVM infrastructure, the two systems will integrate closely in the future. As the Nexus zkVM evolves — with version 4.0 targeted for the first half of 2026 — every interaction on the DEX will become provable as part of the Universal Proof architecture. That will allow for full cryptographic verification of trades, orders, and executions.

The DEX is built into the Nexus Layer 1, which leverages the Compute Network via the zkVM. So while there is not a direct connection between the zkVM and the DEX, they do share the Nexus Layer 1 in common. In biological terms they are like different species but with dependencies in the same ecosystem.

Because exchange is not just one application among many — it’s the foundation for programmable, verifiable finance.

With the Nexus DEX, we’re demonstrating what’s possible when high-performance infrastructure, cryptographic verifiability, and seamless composability converge at the protocol layer.

The alpha is live. Early access is rolling out. And if you’re serious about building or trading on the next frontier of decentralized finance, now’s the time to get involved.

Request access. Help shape the future.